For the global semiconductor industry, the just-revealed truce in the “trade war” between U.S. President Donald Trump and China’s president Xi Jinping is welcome news but hardly the end of a poorly scripted economic melodrama that continues to pose dire consequences for the American semiconductor market.

In a quiet victory for China and its 5G ambitions, Trump and Xi agreed Saturday to resume trade talks that had collapsed in May. Concessions offered by President Trump include no new tariffs and an easing of restrictions on trade with Huawei, in exchange for China making unspecified new purchases of U.S. farm products.

The outcome of the negotiations between Trump and Xi in Osaka is not exactly a big breakthrough. It is said to be broadly in line with market expectations ahead of the summit. Removal of the immediate risk of much higher tariffs, however, is likely to generate a relief rally in the financial markets. [ As of mid-day Monday, most U.S. exchanges and indices were up no more than 1 percent — ed. ]

The U.S. Commerce Department, according to Trump, will “study in the next few days whether to take Huawei off the ‘entity list.’” The entity list is a de facto blackballing of the Chinese telecom equipment giant; U.S. companies have been banned from selling parts and components to Huawei without U.S. government approval. Some key international vendors had also agreed to cut off sales to Huawei.

Two weeks ago, Broadcom surprised the industry by revealing that the U.S.-China trade tensions and the ban on doing business with Huawei would knock $2 billion off the company’s sales this year.

The global chip market to shrink by $100 billion in 2019

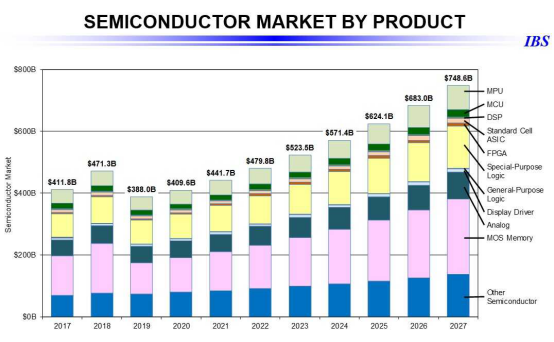

Last week at an event held by CEA-Leti in Grenoble, France, Handel Jones, the founder and CEO of International Business Strategies, Inc., warned the audience, “If the U.S. and China do not find a way to ease the current trade tension, we are expecting the global semiconductor market in 2019 to shrink by 18 percent — roughly $100 billion — compared to 2018.”

After the so-called "truce" was announced by President Trump, Jones told EE Times, "The data (above) I shared in Grenoble is based on tariffs for $300 billion, which is [now] postponed." Noting that IBS is currently redoing the chart, Jones said he estimates a decline [of the global chip market] to be closer to $80 billion, instead of $100 billion. "It is still a large decline," he added. "Most of the decline comes from dips in DRAM and NAND."

The latest cease-fire in the trade war between the world’s largest nations might narrowly avoid immediate disaster. But is returning to the negotiation table — a low bar — enough to remove the business community's concerns over the uncertainty between the two countries? Executives in the chip industry often complained that it is "this uncertainty —not knowing what Trump does next" that's killing their business.

Further, it remains unclear how this will eventually lead to any resolution on the fundamental conflict between the two nations.

The United States’ concerns on China range from issues of intellectual property thefts and China’s industrial policy to Huawei’s close relationship with Beijing and potential national security risks posed by Huawei’s next-generation 5G telecommunication infrastructure equipment. China, meanwhile, is asking for the U.S. to treat Chinese companies fairly and show mutual respect.

It appears that the U.S. President, eager to use Huawei as a bargaining chip for short-term leverage, is trading away his administration’s original concerns over national security and IP thefts.

Jones observed that Senator Marco Rubio is trying to tighten the restrictions on shipping products to Huawei and he has support in the Senate as well as in Congress. The reality is, said Jones, "Nothing is firm and everything is up for negotiations."

"IBS' position is that China and Huawei will be hurt in the next 2 to 3 years, but longer term, China will be stronger," noted Jones.

Future of 5G

One thing is clear. As IBS’ Jones noted, the race to 5G technology has been already won by Huawei in China (with Ericsson as runner-up and Nokia a distant third). The ongoing tension between the United States and China is not helping the U.S. either to kickstart 5G domestically or take the lead in the global 5G race.

Asked for proof that China has won the still emerging 5G market, Jones told us that Huawei has already made more than 50,000 5G base station equipment sales to all the leading telecom operators in China and broadcasters. Early installations of 5G telecom equipment in the field are helping Huawei gain in-depth insights and learn lessons fast, he told EE Times.

Most likely, global 5G market will be split in two — with China honing, advancing and creating its own 5G standards, Jones predicted. And the United States? “We might have to license IPs on 5G from China.”